LEGO Investment Tips and ROI 2025

Podíl

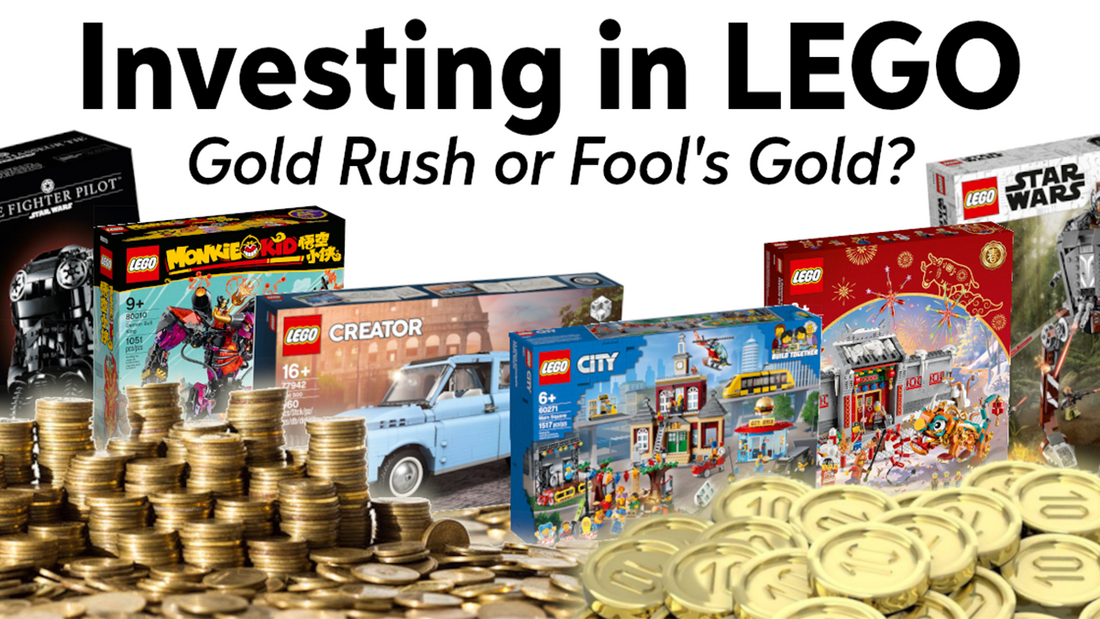

As a seasoned observer and participant in alternative investments, I can confidently say that investing in LEGO sets has evolved from a niche hobby into a recognized asset class with promising ROI potential. Over recent years, LEGO pieces have demonstrated steady appreciation rates, often outperforming traditional investment vehicles such as stocks, bonds, and precious metals. This emerging market combines the thrill of collecting with the discipline of strategic investing, offering unique opportunities for both enthusiasts and savvy investors seeking portfolio diversification.

The appeal of LEGO investment lies in the blend of rarity, brand strength, and cultural relevance. Limited-edition and retired sets, especially those tied to iconic franchises like Star Wars or Harry Potter, have consistently shown robust value growth over time. However, LEGO investing demands nuanced understanding—from identifying which sets to buy before retirement, to optimal holding periods, and navigating resale platforms for maximized ROI. Drawing upon comprehensive market data, expert strategies, and firsthand portfolio management experience, this guide dives deep into key LEGO investment tips, analyzing expected returns and how to build a successful LEGO collection that pays dividends.

Whether you aim to supplement your income or build a long-term alternative asset, mastering LEGO investment fundamentals will empower you to make informed decisions and capitalize on this highly liquid and enjoyable market.

CADA BRICKS® Best Sellers - SHOP NOW

Why Invest in LEGO Sets? Understanding the ROI Potential

LEGO is not just a toy manufacturer; it has become a force in the alternative investment market. Research has shown that LEGO investments yield an average annual return of at least 11%, outperforming several major asset classes including stocks and gold. This remarkable performance is driven by several factors:

- Limited production runs and retirement: When LEGO discontinues a set, supply becomes fixed while demand from collectors and fans often increases, pushing prices up.

- Brand recognition and fandom: Popular franchises maintain high demand, ensuring ongoing value.

- Tangible asset with cultural value: As physical collectibles, LEGO sets offer emotional appeal alongside investment security.

For example, Star Wars Ultimate Collector Series (UCS) sets, like the LEGO 75313 AT-AT, are notoriously valuable post-retirement, appreciating at estimated annual rates around 6% or more. The intersection of rarity, nostalgia, and craftsmanship is a winning formula for investors.

CADA BRICKS® Supercars - SHOP NOW

CADA BRICKS® Best Sellers | CADA BRICKS® Supercars & Racing Cars | CADA BRICKS® Trucks & Construction | CADA BRICKS® Military & Weapons | CADA BRICKS® Initial D

Key LEGO Investment Tips to Maximize ROI

Investing in LEGO sets requires strategy. Here are the core tips to build a profitable LEGO portfolio:

1. Focus on Sets Nearing Retirement or Recently Retired

Sets tend to appreciate most after being retired, when they are harder to find. Keeping track of retirement dates and buying sets close to their sunset can lead to significant gains. For instance, the LEGO 76218 Sanctum Sanctorum and LEGO 76414 Expecto Patronum sets retiring mid-2025 are strong contenders for growth due to limited future supply.

2. Prioritize Limited-Edition and Franchise Sets

Investing in sets linked to major franchises such as Star Wars, Harry Potter, Marvel, or exclusive designer collections increases market demand. Limited edition runs, like the LEGO 910042 Lost City (produced in just 30,000 units), achieve high resale values because of their scarcity and appeal.

3. Buy in Bulk or Through Investment Funds

Some platforms offer LEGO investment funds where you can buy shares in vetted LEGO portfolios, reducing individual risk while spreading exposure across promising sets. Bulk buying rare or in-demand items during Q4 (holiday season) often yields a good entry point.

4. Monitor Secondary Markets Carefully

Primary retail prices don't always reflect investment potential. Platforms like eBay and Amazon provide price tracking and help identify optimum selling times—usually 12 to 24 months post-retirement. Listing conditions and complete original packaging also affect ROI.

5. Maintain Condition and Packaging

Like most collectibles, mint condition and sealed packaging maximize resale price. Store sets carefully and avoid premature opening unless the set is designed for display or artistic uses where building adds value.

CADA BRICKS® City Landmarks - SHOP NOW

CADA BRICKS® Licensed Cars | CADA BRICKS® Classic Cars | CADA BRICKS® Motorcycles & Bikes | CADA BRICKS® Off-Road & 4x4 | CADA BRICKS® Emergency Vehicles

Assessing ROI: What Returns Can You Expect?

Based on current market trends and expert analysis, typical ROI scenarios for LEGO investments look like this:

Many investors report average returns between 20-30% over two years, especially when focusing on well-chosen retired sets with strong brand appeal. However, these gains require patience, strategic buying, and well-timed sales.

CADA BRICKS® Technic Sets - SHOP NOW

CADA BRICKS® Japanese Street | CADA BRICKS® City & Landmark | CADA BRICKS® Science & Educational | CADA BRICKS® Technic | CADA BRICKS® Modern Architecture

Common Pitfalls and How to Avoid Them

- Overpaying for popular sets too early: Buying sets at MSRP or above right after release might not guarantee high ROI unless the set legitimately retires soon.

- Ignoring market saturation: Some sets have high print runs, limiting their appreciation.

- Poor storage and handling: Damaged boxes or missing pieces drastically reduce resale value.

- Lack of research: Following unverified “hot picks” without understanding the secondary market risks losses.

CADA BRICKS® Display & Collectibles - SHOP NOW

CADA BRICKS® Castle Building Blocks | CADA BRICKS® City Building | CADA BRICKS® Remote Control | CADA BRICKS® Display & Collectibles | CADA BRICKS® Anime & Pop Culture

How to Start Your LEGO Investment Journey

- Research and Follow LEGO Retirement Lists: Reliable sources publish anticipated retirement dates. Mark those for your watchlist.

- Set a Budget and Diversify: Avoid putting all funds into one set; diversify across themes and risk levels.

- Engage with Communities and Experts: Online groups, newsletters, and platforms like Splint Invest provide valuable insights and curated portfolios.

- Track Market Prices and Trends: Use tools to monitor ecommerce platforms for price fluctuations.

- Decide on Duration: Most successful investors hold sets for 1-3 years, but some flagship collectibles may require longer patience.

CADA BRICKS® Remote Control Sets - SHOP NOW

CADA BRICKS® Mechanical Engineering Building Blocks | CADA BRICKS® Kids Building Blocks | CADA BRICKS® Teens Building Blocks | CADA BRICKS® Adult Building Blocks

Conclusion: Turning Play into Profit with LEGO Investments

Investing in LEGO sets represents a fascinating intersection of passion and profit. With an average ROI that rivals or surpasses traditional markets, combined with the joy of collecting iconic pieces, LEGO is a compelling alternative investment. By applying disciplined strategies—focusing on limited editions, understanding retirement dynamics, and actively managing your collection—investors can build a rewarding portfolio. Remember, like all investments, LEGO requires informed decisions, structural planning, and a long-term horizon to maximize gains.